South Korea’s push to have world’s first carbon-free island

December 27, 2017

French company ENGIE lays out 5.2 GW renewable goal

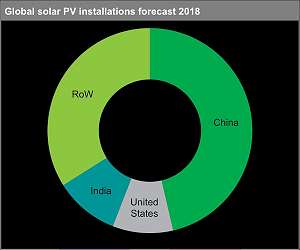

December 27, 2017Largely driven by an improvement in the outlook in China, global photovoltaic (PV) demand is forecast to reach 108 gigawatts (GW) in 2018. According to business information provider IHS Markit strong demand from the Chinese market is expected to continue on the back of strong policy support, a successful transition to a more diverse market and strong momentum in the distributed-PV (DPV) sector.

“Exceeding 108 gigawatts of PV installations is close to the top-end of what can be achieved, based on the global polysilicon manufacturing capacity,” said Edurne Zoco, research and analysis director for IHS Markit.

“Supply will therefore be tight throughout the first half of the year at least, resulting in stable to higher prices across the supply chain.”

According to the latest edition of its PV Demand Market Tracker, global installations will likely be shaped by PV module supply and pricing.

“Short supply and higher-than-anticipated module prices in the first half of 2018 will impede many markets outside China, due to worsening project economics,” Zoco said.

“Projects in some regions might be delayed or even canceled, because market prices are higher than were estimated during the planning phase.”

In a marked change from the past, Chinese PV module suppliers are now prioritizing their domestic market. At one time China represented one of the lowest-priced PV markets, but after prices increased in 2017, China became an attractive market for local manufacturers. As a result, supply to other regions is restricted when demand in China is strong.

In addition to the expected shortfall in PV modules, following are the two most important factors influencing the PV outlook outside of China next year:

1. The United States, which is still forecast to be the second-largest PV market in 2018, is facing significant policy uncertainty. President Trump’s final ruling on Suniva’s 201 petition case could significantly affect global PV economics in this market. Planned corporate tax reforms could also significantly weaken investor interest in the sector. The relationship between supply and demand has already become distorted, due to the stockpiling of modules ahead of the 201 decision.

2. India, the third-largest market in 2018, is mulling the introduction of anti-dumping duties for modules manufactured in China in the second half of 2018. The country has also announced tenders for projects with local content. Such measures may limit the amount of modules available to supply India’s PV demand over the next few years, unless local manufacturers ramp up production quickly.

Source: www.solardaily.com